Members of a Limited Liability Company Share Profits

It is not uncommon for LLC members to structure their rights in unique ways regarding how management authority is shared and how profits and losses are split. The current members hold capital interests in the LLC which we would typically call the Class A Units and the recipients of the profit interests would likely receive.

Nonprofit Limited Liability Company Nonprofit Law Blog Limited Liability Company Sole Proprietorship Llc Business

In most states the owners of a limited liability company can determine a legitimate method of splitting profits that makes sense for their membership and their business.

. Members of a limited liability company share profits. Moreover in some cases an operating agreement can restrict the type of ownership interest that an heir receives at the time of a members death to one of these two categories rather than. LLC members often play key roles in the day-to-day management and operations of their businesses and may want to receive additional.

Instances where limited liability company owners would opt to have a manager managed business structure include having a roster of members so large complex and diverse that allowing each member a share in management would not be efficient or when members of a limited liability company are not particularly skilled when it comes to LLC management. In proportion to their capital contribution. A limited liability company with multiple members that elects to be taxed as partnership may specially allocate the members distributive share of income gain loss deduction or credit via the company operating agreement on a basis other than the ownership percentage of each member.

For example lets say an LLC has two members with one owning 60 of the company while the other owns 40. Then each member gets taxed on their distribution of profits. An LLC members ownership interest is tracked in that members capital account.

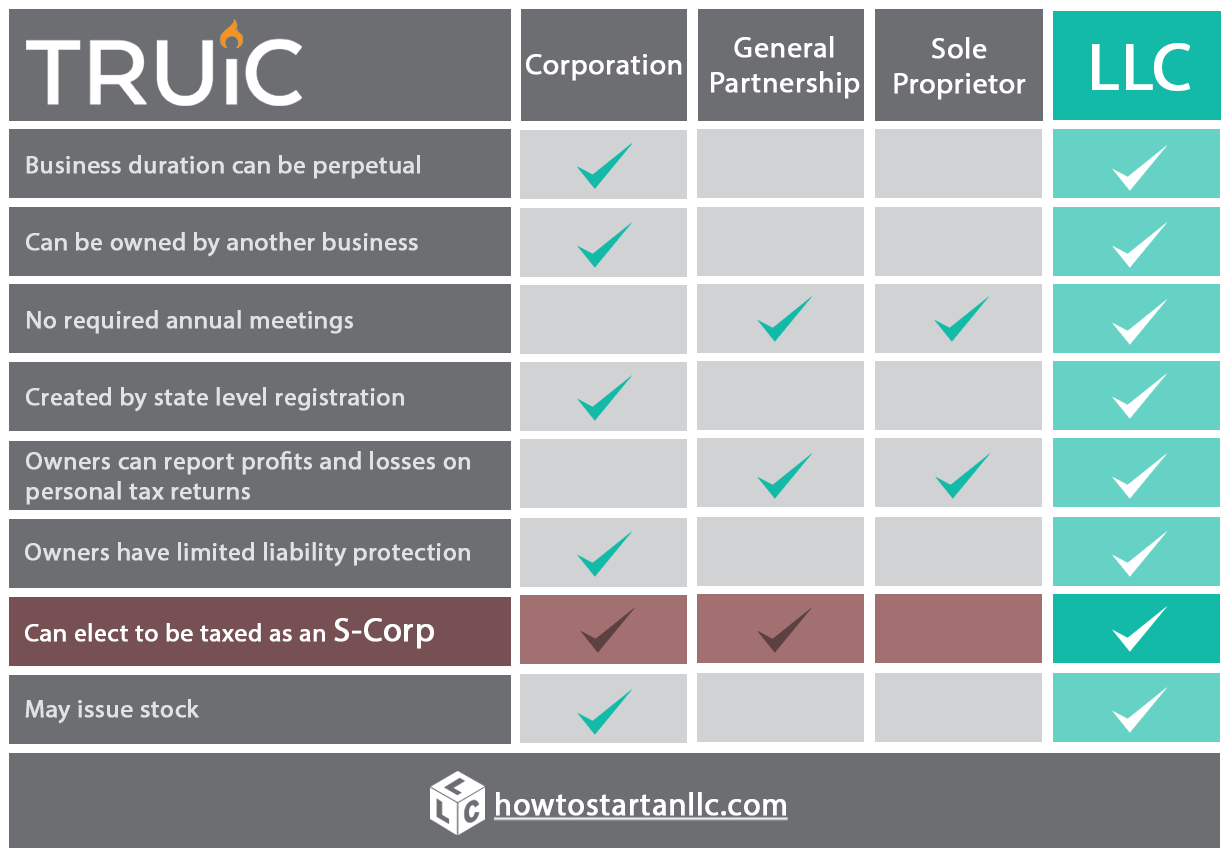

A member has no interest in specific limited liability company property. The LLCs members include their share of the LLC profits on their personal tax returns. Members of a limited liability company share profits.

A limited liability company LLC is a legal form of enterprise owned by one or more members that may be organized and operated for a wide variety of purposes including charitable purposes. C in proportion to their capital contribution. In proportion to their contribution of services.

Nonprofit Limited Liability Company. In proportion to their contribution of services. When a company generates a profit and accumulates retained earnings to owners.

The LLCs operating agreement establishes those ownership rights. Interest means a Members limited liability company interest in the Company which represents such Members share of the profits and losses of the Company and a Members right to receive distributions of the Companys assets in accordance with the provisions of this Agreement and the Name of State Act. D according to the terms of the operating agreement.

Today I answered a LinkedIn question about forming an LLC where some members have no ownership of the LLC but receive a share of cash resulting from the businesss profits their economic interestThe question and answer are reproduced in somewhat edited form below. Up to 10 cash back By virtue of acquiring an interest in a limited liability company members receive certain financial rights. Typically to create and issue profits interests an LLC will have to amend its operating agreement to create a new class of membership interests or units that will take the form of profits interests.

In proportion to their capital contribution. According to the terms of the operating agreement. According to their status general or limited in the firm.

A according to their status general or limited in the firm. In a multiple-member LLC the operating agreement determines each members share in the duties of the business and in the profits and losses of the business. These financial rights include the right to share in allocations of the companys profits and losses.

O a according to the terms of the operating agreement. In the case of a single-member limited liability company it is up to the laws of the state whether the LLC will be dissolved automatically or if ownership is transferred to the deceased members heirs. Instead the DE LLC Act defines a limited liability company interest as a members share of the profits and losses of a limited liability company and a members right to receive distributions of the limited liability companys assets a definition that only includes economic rights and does not include control rights such as the rights to manage the LLC.

A A limited liability company interest is assignable in whole or in part except as provided in a limited liability company agreement. One of the major advantages of an LLC is the limited liability protection it offers to its members. The problem with an oral agreement is that it is a recipe for disaster because when people disagree they have no way to prove what they previously agreed.

With double taxation income gets taxed both at the corporate level and also when distributed as dividends Dividend A dividend is a share of profits and retained earnings that a company pays out to its shareholders. B in proportion to their contribution of services. The members have agreed.

Members of a limited liability company share profits. Members also have the right to share in distributions of the LLCs assets during its existence and when it dissolves and liquidates. Assignment of limited liability company interest.

Members of a California limited liability company must agree in an oral agreement or in a written and signed Operating Agreement as to how profits and losses will be allocated among the members. Since I first wrote this post LinkedIn has shut down its QA feature so you no longer. 434 1.

The capital account will include a members capital contributions as well as allocated profits. With an LLC income is only taxed at an individual member level. The assignee of a members limited liability.

A multiple-member LLC is taxed as a partnership so each members share of the net income or loss is passed through to the members personal tax return. If a company doesnt specify a profit sharing formula the profit is shared according to each members ownership percentage as determined by his relative capital account balance. According to their status general or limited in the firm.

The executor may share the profits but does not participate in running the business. Members of a limited liability company LLC taxed as a pass-through entity receive business profits and losses in direct proportion to their share of ownership.

Partnership Bookkeeping Business Business Management Accounting

Comments

Post a Comment